Current Home Equity Interest Rates

Table of Content

The credit union also allows you to borrow up to 100% of your CLTV for a first and second home, which is higher than most competitors. A home equity loan makes more sense for a large, set expense because it’s paid out in a lump sum. If you have smaller expenses that will be spread out over several years, such as ongoing home renovation projects or college tuition payments, a HELOC might be a better option. Home equityis the difference between the balance owed on your mortgage and your home’s current market value. Simply put, it’s the share of your house that you own because you’ve paid down your mortgage balance and/or your property’s value has increased over time.

Be prepared to have financial documents at the ready such as pay stubs and Form W-2s as well as proof of ownership and the appraised value of your home. Connexus home equity loans are not available in Maryland, Texas, Hawaii and Alaska. TD Bank home equity loans are only available in about 16 states.

Compare top rates

Over time, you build up equity in your home as you make payments on your mortgage or your home’s value rises. If you have built a substantial amount of equity in your home, you can take out a home equity loan. Home equity loans are installment loans that allow you to borrow a percentage of your home equity, typically up to 85 percent.

After you use the funds to pay off your existing mortgage, you’ll be left with $50,000 in cash . A cash-out refinance is when you pay off your existing home loan by getting a new one that’s larger than what you currently owe. You then get a check for the difference and can use that money on anything you’d like.

Cross-Border Banking

Payments shown exclude taxes and insurance; total payments will be higher. The drawback of HELOCs is that they usually come with variable interest rates. This means that your interest rate and monthly payment could rise depending on the prime rate. Cash-out refinancing makes sense when you can get a lower refinance rate than your existing mortgage rate.

Home equity and the personal wealth it can build isn’t meant to be treated like a cash jar. Buying a home provides a basic need, but it’s also a long-term investment for most people. Your home equity can be a resource when you need to use it, but it should be used with careful consideration and planning. At Bankrate, our mission is to empower you to make smarter financial decisions. We’ve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers.

What is a home equity loan and how do you calculate it?

The rates shown above are calculated using a loan or line amount of $30,000, with a FICO score of 700 and a combined loan-to-value ratio of 80 percent. A home equity loan is an installment loan based on the equity of the borrower's home. Most home equity lenders allow you to borrow a certain percentage of your home equity, typically up to 85 percent.

Bank’s home equity loans, which could save you thousands of dollars. Bank is now the fifth-largest bank by assets in the country, with about 3,000 branch locations in 27 states. See competitive home equity rates from lenders that match your criteria and compare your offers side by side.

year loan at 6% interest

Most HELOCs come with variable rates, meaning your monthly payment can go up or down over the loan’s lifetime. Some lenders now offerfixed-rate HELOCs, but these tend to have higher interest rates. After the draw period, you enter the repayment period, in which any remaining interest and the principal balance are due. Repayment periods tend to be longer than draw periods — anywhere from 15 to 20 years. Discover is well known for its rewards credit cards, but this national bank also offers a full lineup of banking services, such as checking and savings accounts, personal loans and student loans.

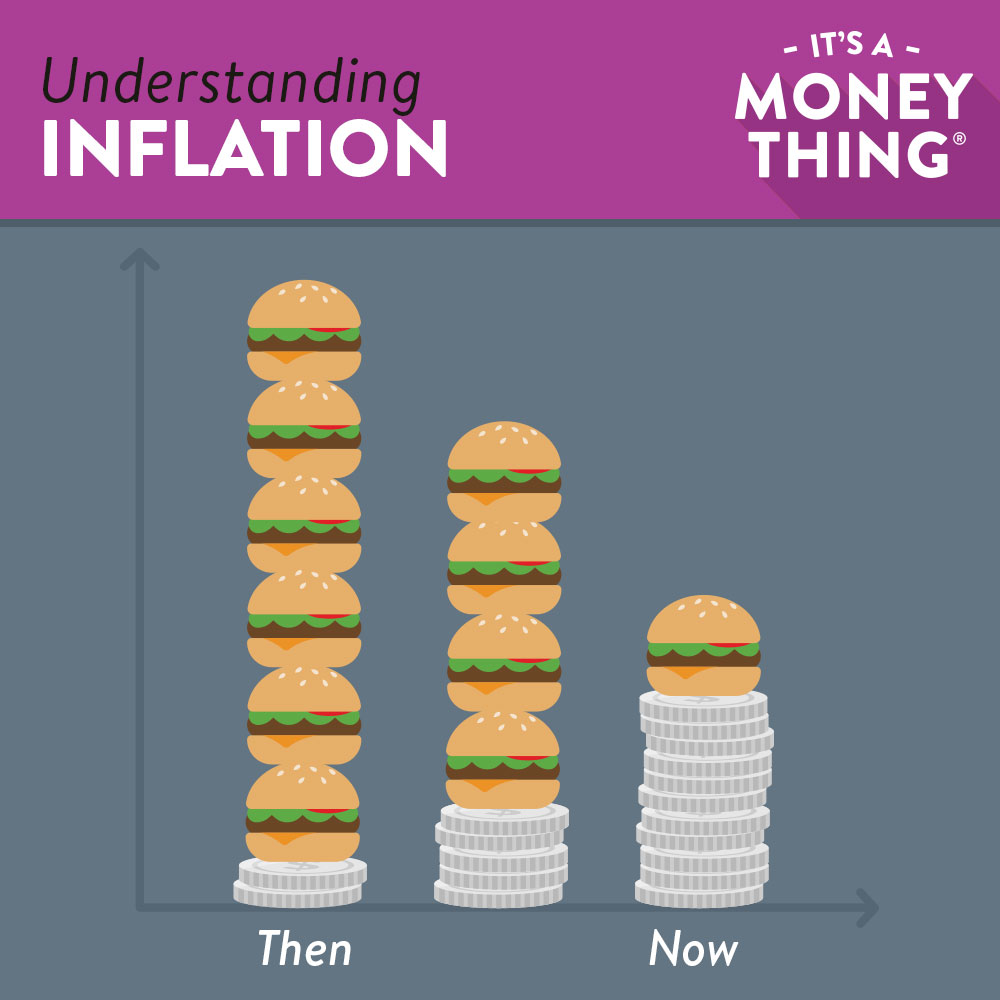

Connexus offers expansive nationwide availability and has several product offerings, part of the reason this lender ranked highly for us. Its straightforward application process is another bonus that makes applying for a home equity loan or HELOC easy. Home equity loan rates are climbing given inflation and ongoing interest rate hikes by the Federal Reserve. Here are the average rates for home equity loans and HELOCs, as of Dec. 14, 2022.

Home equity loans are a great way to use the equity you have in your home. You can get product, rate and fee info after you choose your location. You could check for misspelled words or try a different term or question. Sharing your property’s zip code will let us provide you with more accurate information. If you have enough equity in your home, you can use the money from a home equity loan to buy a second house. However, you should weigh the risks and benefits carefully before using equity to buy another home.

The rates are often higher than home equity products, but you won’t have to worry about the lender foreclosing on your home if you default. Homeowners ages 62 years or older may be able to convert their home equity to cash, monthly income or a line of credit through a reverse mortgage. Rather than having to make a payment on the amount borrowed, the interest is added to the loan each month. Some home equity lenders allow you to borrow on a second home or investment property, but at much lower LTV limits than a primary residence.

You can’t deduct home equity loan interest if you use the money for other purposes, such as paying for college tuition or consolidating debt. If a company offered both home equity loans and HELOCs, we evaluated its home equity lending as a whole rather than any specific product. Opened in the midst of the Great Depression in 1938, Third Federal Savings & Loan sought to help unemployed and underemployed Ohio residents achieve home ownership.

They offer a fixed interest rate and monthly payment so you get a predictable repayment schedule for the life of the loan. A Loan Estimate provides important details about your loan, including the estimated interest rate, monthly payment and total closing costs. A banker can help you obtain a Loan Estimate without completing a full loan application.

How much can I borrow with a home equity loan?

It may take two to four weeks to close on a home equity loan. You’ll usually receive your funds after a three-business-day waiting period after your closing. Because a HELOC is a credit line, you only make payments on the balance you charge, plus interest. If debt management has become a burden, a home equity loan could help you consolidate your debt into a single, more manageable payment at a competitive rate. For one-time home remodel projects, a home equity loan is a great option. Not only are you improving your home, you’re reinvesting the money back into your property.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. Based on the funds you initially use when opening the HELOC. Unexpected costs, education expenses, or the need to consolidate debt. We ask for your ZIP code because we need to know your time zone so we can call you during the appropriate business hours.

Comments

Post a Comment